Real estate crowdfunding reached an all-time high during the Corona crisis. Property crowdfunding deals increased considerably, accounting for 17% of all investments for the post-pandemic period. As lenders slowed down their activities during the pandemic, more sponsors turned to real estate crowdfunding sites as a source of capital needed to carry out their projects.

Given a stable growth in the demand, building a real estate crowdfunding platform presents an alluring business opportunity in 2023. Based on our six-year experience in real estate development, the JatApp team has prepared this article to clear up any uncertainties that you might have when planning to create your own real estate crowdfunding platform.

What is real estate crowdfunding? Definition and examples

Real estate crowdfunding is the practice of financing a property project with relatively small contributions from a large number of investors. Crowdfunding allows businesses to quickly raise money for property projects while enabling investors to become shareholders in real estate or a company. Real estate crowdfunding platforms serve as a marketplace connecting investors and sponsors or, in other words, businesses running the deal.

We’ve analyzed the real estate crowdfunding market in search of key players and new successful startups. Here are three good examples to look up to.

Concreit

Concreit is an online platform that lets users invest in real estate for as little as $1.The company empowers people, regardless of their income, to benefit from real estate investment opportunities that were once possible for wealthy individuals only.

The platform makes profits by charging a 1% fee for investment portfolio management. Apart from that, the startup receives part of the profit when all fees are paid out to investors. Concreit also charges the commission from users who withdraw their investment earlier than by the end of the term.

Concreit app functionality

Fundrise

Fundrise is one of the largest real estate crowdfunding platforms for non-accredited investors. The company acquires an asset for less than its estimated value and makes renovations over time. Before any real estate project gets accepted, the platform performs a comprehensive due diligence process to evaluate whether the property is worth fundraising. Once Fundrise approves and renovates the asset, investors can receive passive income from having shares in the property.

The company charges a fee from users for giving advice on their investments. Apart from that, real estate investors are expected to pay a fee for asset management on an annual basis.

Fundrise dashboard

Crowdstreet

Crowdstreet is an online platform that offers commercial real estate investment opportunities to accredited investors. The company’s advisory services allow investors to compare deals and find real estate that matches their unique needs.

Crowdstreet has a pretty straightforward real estate crowdfunding business model. Sponsors pay the company for raising money on its platform and for using software that manages multiple deals.

Crowdstreet app functionality

Types of crowdfunding investments

Crowdfunding investments types, otherwise known as crowdfunding deals, define investment opportunities. You may find two kinds of deals on real estate crowdfunding platforms: debt and equity deals.

Debt deals

Investors that opt for debt deals act as a bank. They lend their capital to property owners and receive payments at a set rate of interest. The original amount of capital is paid back to investors at the end of the term. Debt investing is a good choice for investors who are searching for a relatively low-risk offer and fixed rate.

Equity deals

Equity deals make investors part owners of real estate. Equity investments usually have higher investment risks, but promise greater returns than debt investments. There are three types of equity investments, namely, single syndication, funds, and real estate investment trusts (REIT).

-

Single syndication

Single syndication deals allow investing in a single real estate and include apartment and syndication deals.

If it’s an apartment deal, the sponsor takes investors’ money to buy an apartment building and make renovations to increase its rental income. Investors are paid a set fee before sponsors receive any income. Once sponsors get their returns from investment, they pay back investors a percentage from profits.

Syndication deals typically refer to financing new constructions. Unlike apartment deals, investors get the percentage from the profits once the property is sold or rented, plus their original capital investment at the end of the term.

-

Funds

Funds enable investors to purchase shares of multiple properties. The main advantage of this investment type is that investors can lower their risk by diversifying the returns from multiple types of real estate. Funds-based platforms usually charge higher fees from investors, since access to several properties presupposes more administration and management work.

-

Real estate investment trusts (REIT)

REIT is a business that invests and owns a certain property to eventually gain profit. Investors can purchase shares of the REIT and when the REIT gets income from real estate, investors get their percentage.

Now that you know the difference between equity-based and debt-based platforms, it’s time to shed some light on what niche you can choose to enter with your crowdfunding platform.

What crowdfunding niche to enter?

When planning a crowdfunding platform, it’s important to decide on the types of real estate you’ll concentrate on. Focusing on a single niche will mean that you’ll face less direct competition, which enables you to become a big fish in a small pond. You can also excel more easily with special knowledge or skill set in a specific industry, making the platform the best it can be for target users.

There are two major niches in the real estate crowdfunding market: commercial and residential real estate. The Covid pandemic has brought many long-lasting trends to both niches. Let’s discuss what has changed in commercial and residential real estate after Covid-19 to help you make a more informed decision.

Commercial real estate

Commercial properties refer to real estate used for business purposes only. They include but are not limited to hotels, office buildings, shopping centers, medical buildings, and similar.

Investing in commercial real estate can bring expected returns, but only if investors have a clear understanding of today’s market demand. In the past, commercial properties tended to generate larger incomes compared to residential real estate, as renters were usually always available. With the spread of coronavirus, the commercial real estate market has been hit hard, as many businesses were forced to adopt the work from home policy.

To make investments in commercial properties more promising, yet less risky, it’s recommended to focus more on assets that remain in high demand now, like healthcare facilities, pharmacies, data and logistics centers, and such.

Residential real estate

Residential properties refer to living spaces rather than workplaces. Condos, apartments, and houses make a good example of residential real estate.

Today, many investors consider residential real estate less risky. The current pandemic has made more people interested in buying a home, thereby making the residential real estate market boom in the last couple of years. Bigger houses are now in a particularly strong demand. People need more space in their homes to be able to work without being distracted by other family members. Another good investment opportunity in 2023 is to finance properties located in the suburbs. The Square Yards report suggests that 56% of homebuyers want to move out of cities to support their health and wellness during the pandemic.

Tips for dominating in your niche market

Once you define the niche, you may start thinking about ways to beat your competition. Let’s wrap up the key strategies that will help you gain a competitive advantage:

Get to know your target audience

Think about your users’ income level, place of living, age, occupation, common problems, and similar. Understanding who your potential investors are and their pain points will help you come up with a solution to satisfy their needs.

As an example, Concreit has managed to build a platform that resonates with ‘‘regular’’ people who want to become more financially stable. Instead of trying to appeal to everyone, the platform focuses on small investors who want to have passive income without the burden of managing one’s own rental properties. Concreit’s target audience is interested in single-family rental homes, but have neither enough cash to buy their own real estate nor the time to make repairs at 1 a.m. on Sunday.

Concreit investment platform

Analyze competition

The next thing you need to do is to define the major players in the sector. According to Investopedia, the crowdfunding giants in today’s market are Fundrise, Crowdstreet, DiversyFund, EquityMultiple, PeerStreet, and RealtyMogul.

Pay close attention to competitors’ offerings that have become attractive in the eyes of investors. As an example, market leaders mentioned above allow users to benefit from easy-to-find investment information, a large selection of property listings, institutional quality offerings, and so on. Learning what features investors have and like will help you build a product that meets current market standards.

Think about offerings that investors lack

To stand out from your competitors, you need to make offerings that investors would like to have, but have a hard time finding on the market. For instance, few platforms to date have mobile applications and early withdrawal options for investors.

Coming back to Concreit, this crowdfunding startup has managed to capitalize on closing the gap in the offerings. The company focuses mainly on mobile app users, allowing them to easily finance a project with the swipe of a finger on their smartphones. On top of that, investors can withdraw their capital through the mobile app any time convenient for them. It’s no wonder that the startup received $6M in funding last year.

Unique features to add to a crowdfunding platform

After choosing the niche and learning how to compete in the market, it’s time to build the product that will be relevant in a dynamic crowdfunding sector. We’ve picked out three advanced features that your platform should have to ensure a superior user experience and give you a competitive edge.

Fully automated investments

Auto-investment is the crowdfunding platform feature that allows users to automatically take part in deals that meet their own pre-selected criteria. Investors are no longer requested to log into their investment accounts and manually make their contributions. As long as users have money available in their bank account, they won’t need to compete for newly opened real estate projects — the tool will automatically make investments for them. This functionality assists users in building a diversified portfolio, while taking advantage of new investment opportunities.

Crowd Estate automated investments feature

Payment gateway supporting different currencies

Accepting payments in different currencies will increase the number of investors willing to make their contributions. In the last year, global real estate investments have exceeded pre-pandemic levels by 77%, while Europe has witnessed an 80% increase in property investments. Given this tendency, building a crowdfunding software that supports multiple currencies will give you a significant competitive advantage over other well-established platforms that do not have such a feature. Some common currencies to include are euros, yuan, rupees, yen, Canadian dollars, Australian dollars, and Singapore dollars.

Payment gateway that supports Bulgarian currency

Chatbot feature

A chatbot refers to the virtual assistant driven by artificial intelligence that investors can interact with on a crowdfunding platform through a chat interface. Not all users are seasoned investors and may not know where to go and find answers to their questions. Moreover, some may not even know what investments they’re interested in.

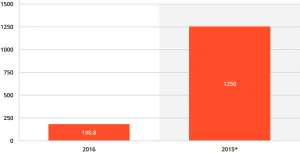

As you can see in the picture below, the future of the chatbot market seems optimistic with the projected increase up to an overwhelming $1.25B in 2025. Few real estate crowdfunding platforms currently offer chatbots to assist users to make more informed investment decisions. Adding this feature will help your platform stay up-to-date in the years to come.

The expected increase in the size of the global chatbot market in 2025

Why build a crowdfunding platform with JatApp?

Almost a decade ago, it would have been hard to believe that someone could raise millions of dollars from many unfamiliar investors in a few minutes. In 2023, however, it happens daily through real estate crowdfunding platforms. The future of this sector seems very bright, as it continues to evolve in the face of Covid-related challenges.

If you want to develop real estate crowdfunding software, you’ll need a trustworthy vendor to build a competitive product that appeals to investors. JatApp can become your trusted partner in developing your crowdfunding platform. Our company is included in the world’s top 1,000 B2B software vendors according to Clutch with more than 200 completed projects and a 99% satisfaction rate. With us, you can save up to 60% on development costs compared to other vendors in Western markets. Don’t hesitate to contact us and we’ll contact you shortly to discuss project details.